As a CERTIFIED FINANCIAL PLANNER®, people treat me as a friend, a confidant, a therapist, a coach, a quarterback and a guide.

Some of my clients were very successful in business and are now living off their wealth. Some are young couples just starting out. And some fall in between.

Through all of my years, I believe I have seen the good, the bad and the ugly of personal finance.

Which happens to be GREAT for you!

Today, in this post, I will share 3 terrible things I have seen clients do to attempt to achieve financial success.

-

Bought whole life insurance with every disposable dollar they had

What is whole life: Whole life insurance is a permanent life insurance contract that is designed to cover you, your entire life while accumulating cash value that you can use to borrow against in the future. Read more about whole life insurance here (3rd party websites are not endorsed by IFS securities)

Awhile back I took on a couple as clients. They were in their 40’s with moderate income. They owned a home and a business. On the surface they were doing ok.

However, when I started learning about their assets, the conversation ended abruptly.

No one was being rude…. There just wasn’t a lot to tell.

Them “we own life insurance.”

That was it… Instead of putting the money in the bank or a 401k they were buying whole life insurance.

Life insurance is a very important piece of a financial plan. It provides security and protection for your loved ones. Some polices (like whole life) can also be used for tax advantaged cash accumulation. So, structured properly, life insurance can be a very good wealth accumulation and legacy tool.

–so it sounds like I am saying whole life is a good thing? I am. So, why is it bad for my clients?

This specific client had 7 POLICIES.

7 SMALL POLICIES.

Here’s the problem. Each policy has its own costs/expenses. Each policy has a long surrender period (time before you can take money out without paying a penalty) and MOST IMPORTANTLY the client did not have an adequate emergency fund or retirement plan.

I can see how MAYBE 1 whole life policy MIGHT make sense to start at a young age. But 7, never.

It got so bad that a few years back (before meeting me) when the client got a little healthier, he applied for a premium reduction, got it and then used the savings to buy—ANOTHER POLICY.

How did I help?

I analyzed all of the policies, discovered that 2 were worth keeping and canceled the rest. We redirected those funds to more liquid investments to better their situation.

My Point:

Using every dollar you have to implement 1 financial strategy that offers no flexibility will lead to financial ruin. Any slight hiccup- a layoff, an injury, a slowdown in business—will blow this financial strategy to smithereens!

-

Bought penny stocks because they thought they had more room to grow

What is a penny stock? Any stock priced $5 or below is considered a penny stock. Read more about penny stocks here ((3rd party websites are not endorsed by IFS securities)

This strategy is a little more obvious one to avoid. But none-the-less people every day are buying low priced stocks and losing their shirts!

One story comes to mind.

Back in 2014 I was introduced to a man who was a self proclaimed successful stock picker. He wanted to meet with me because he was getting closer to retirement and wanted to make sure he was going to be “ok.”

We got together and I started reviewing his current situation. Before he handed me one statement in particular, he told me that during the dot com era (1990-2000) this account was worth north of $500,000. I went further to ask if it was $450,000 of deposits and $50,000 of profits. Which wouldn’t be bad!

In fact, it was close to the opposite! He turned roughly $50,000 into over $500,000 in just under 3 years.

Wow!

Imagine my surprise when I took at look at his account statement and it had a total value of $25,000.

Turns out that during that time he was day trading penny stocks and watching them sky rocket. After the tech bubble burst he lost about 50-60% right off the bat. And since then has been searching for the penny stock to ride back up… unfortunately the opposite has happened.

(lucky for him, he worked for the same company for 30 years, and built up a nice pension and 401k—where they didn’t let him trade penny stocks, so he will actually be “ok” but he did not know it at the time!)

I asked him, why did you only buy penny stocks?

“They have most room to grow”

That thought process cost him over $400,000…..

Under normal conditions (tech era was not NORMAL!) if a stock has traded down to below $5 there might be something fundamentally wrong. Or, the company has not proven itself yet, either way, most likely not an appropriate investment for you.

Also, the share price has no bearing on the growth potential of a stock!

If you invest $1,000 in a stock trading at $50 or 1 cent and it doubles, you have $2,000, either way!

Sadly, many of these penny stocks go up in value because of a pump and dump scam. Check out a famous case here (3rd party website not endorsed by IFS)

A scam like this uses a PR firm to get the stock covered in the media. Suddenly, there are positive articles written and tons of attention flocks to the penny stock. Investors jump all over it and they ride the price up up up until….. Pop! Ride the price wayyyy back down.

How did I help?

I showed the client the benefits of asset allocation and the proper way to build a portfolio. We went over some basic trend following techniques that we use to have greater control of his portfolio.

My Point:

You should always diversify your portfolio and look for sounds investments. Trying to hit a home run with every investment will lead to the most strikeouts. If you want to buy individual stocks instead of funds, make sure you are investing in sounds companies. You also need to be able to buy multiple stocks to spread your risk out.

FYI—if you google “how to trade penny stocks” you get over 3.9million results. Stay away.

Finally…

-

Waiting till you get older to start saving.

Unfortunately this one I have seen way to many times. I don’t have a specific story to share because people who wait too long or won’t save at all ever become clients. They have a “spend it all now” mentality which doesn’t work well with financial planners.

No matter your age you should start to save now! Putting it off 1 day, 1 month, 1 year, just makes it harder and more expensive.

Here is an example to show my point.

Example :

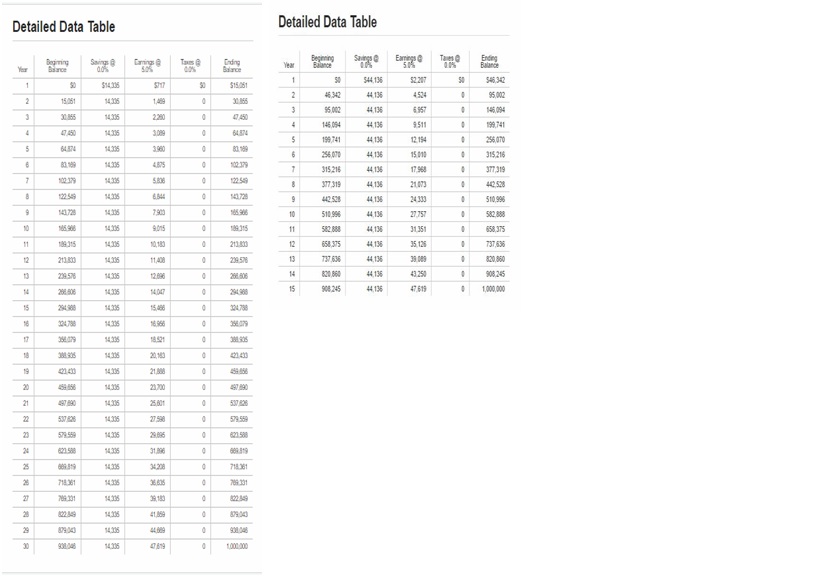

Goal: To have a $1,000,000 saved by age 65

Hypothetical 5% annual interest rate(no taxes and no increase to savings over time in hypo)

Start At 35 Start at age 50

Annual savings Annual savings

$14,335 VS $44,136 <–half the time but more than double the amount

http://www.calcxml.com/calculators/savings-goal-calculator-how-much?skn=#calculator-data-table

As you get older or closer to needing the money for ANY goal, the more you have to sock away. It’s a double edged sword because if you have gone a long time without saving you are not mentality prepared to start reducing your lifestyle to find the cash to save… So not only do you have less time to save it, you have to save MORE as well.

How do I help?

By building a sound financial plan, you can see all of your financial goals and objectives laid out with a plan to accomplish them. A good plan will also show multiple scenarios that includes the cost of waiting.

My Point:

I understand the thought process of wanting to wait to start saving. For some, retirement is 30 years away, college for your kids 18 years… But the fact is, the earlier you start saving the less you have to save per month. Also, you start to build a great habit of living within your means. If financial objectives pop up later in life you will be better prepared because of all the saving you have done.

Recap:

Avoid these financial “strategies” to achieve success. You do not have to recreate the same mistakes others have!

- Spending every dollar you have on whole insurance

- Investing in penny stocks

- Waiting too long to start saving.

I don’t care if your mother, your brother, your trusted advisor recommends anything above. Say NO and do the opposite. And for that, you will thank me.

As always, you can consult with me to discuss your current financial situation

Look for future posts on the best ways to build a global portfolio and check out my recent post on why budgeting stinks!

Thanks for stopping by and I hope you achieve financial success!

One thought on “3 Financial Strategies to Avoid at All Cost”

Comments are closed.